Financial Inclusion Commitment

TMBThanachart is committed to promoting financial inclusion while preventing over-indebtedness among individuals. We believe that access to financial services is a fundamental right that empowers individuals to build a secure future and uplift their financial well-being. Recognizing that access to financial services remains a challenge to various underserved groups in Thailand, the Bank directs the efforts on the following areas:

Financial Literacy

Financial literacy is a cornerstone of sustainable financial inclusion. The Bank provides a wide range of non-financial support focusing on comprehensive education on mindful spending and savings, healthy borrowing, investing for the future, and having sufficient protection. This enables individuals to make informed financial decisions that align with their long-term goals. Through our digital platforms, we aim to equip all individuals, particularly those living in remote areas, with the knowledge and skills necessary to improve their financial well-being according to the Bank’s mission.

Digital Solutions

The Bank leverages technology to enhance accessibility and efficiency in financial services. Our digital solutions not only facilitate convenient access to banking and payment services but also enable secure and transparent transactions. Through mobile banking app and online financial management tools, we strive to bridge the gap between underserved populations and formal financial services.

Inclusive Financial Products and Services

The Bank continues to develop financial products and services based on market survey and customer needs to ensure inclusivity for all groups of customers. Acknowledging that each group of customers is different, we tailor delivery methods to the targeted group’s needs and preferences. In addition, we proactively engage with government agencies, industry association and private sector partners to promote access to financial products and services in Thailand.

Over-indebtedness Prevention

While advocating for financial inclusion, we are vigilant about preventing over-indebtedness. The Bank adheres to responsible lending practices, conducting thorough assessments of borrowers' financial capacity using risk-based pricing approach and offering tailored credit solutions. Through continuous monitoring and personalized financial counseling, we proactively identify and address signs of financial distress to mitigate the risk of over-indebtedness.

Fair Treatment

To ensure fair treatment and sales quality control, the Bank puts emphasis on providing training to all levels of employees who are engaged in delivering financial services to customers. All groups of customers shall receive valuable and sufficient information for decision making with a respectful, non-discrimination and non-disturbing manner. We provide complaint mechanisms that are convenient and accessible for underserved customers, and ensure that the handling of complaints is clear,timely, independent, effective, and fair.

Ultimately, our commitment is to create positive and lasting impact through inclusive financial practices. By promoting financial inclusion and preventing over-indebtedness, we contribute to building a more equitable and prosperous society for all.

The Board of Directors provides strategic guidance and oversees policies and frameworks related to financial inclusion, ensures effective implementation, and maintains the focus on financial inclusion to achieve the Bank’s objectives. The board holds senior management accountable for achieving the targets. The Bank has formed multiple dedicated teams to lead initiatives in key areas such as financial literacy, digital solutions, inclusive financial products and services, prevention of over-indebtedness, and fair treatment.

Financial Literacy

The Bank recognizes the importance of financial literacy as a fundamental knowledge that everyone should have. As a bank, it is our role to help raise awareness and educate people on this topic in order to increase people’s capability to manage their finances and ultimately achieve improved financial well-being.

Since 2017, financial literacy has been identified as one of the key components of sustainability at the Bank. Hence, Financial Literacy Program has been initiated to ensure the effectiveness of the Bank’s strategic focus on building a need-based proposition through advisory services in all customer segments. The program focuses on two areas: building internal competency of basic financial knowledge and understanding and contributing to industry-wide on financial literacy covering 4 main target groups namely employees, customers, community and regulators.

The Bank provides a mandatory financial literacy training for new employees, while continuously develops internal trainings to increase our employees’ capability on financial literacy knowledge, attitude, and behavior. Examples of these trainings include e-learning in a format of a short movie with a set of quiz and activities that lead to measurable actions. The Bank believes before the Bank to provide financial services or actively engage with others about financial literacy, our employees must firstly be competent.

The Bank aims to build a strong relationship and strong financial competency for our clients. Appropriate activities and engagement approaches have been developed based on an understanding of the target group, different levels of maturity and the ground rule of no commercial ties with cross-sells during engagement with the related parties.

Financial Literacy Initiatives

Financial Inclusion Initiative

As ttb’s mission is to improve our customers' lifelong financial well-being, we recognize the critical role of financial inclusion in supporting this goal. We aim to provide financial inclusion for all clients, including underserved groups such as individuals in rural areas, women, people with disabilities, microbusiness owners, and those burdened by household debts and over-indebtedness.

Our focus is on equipping them with the necessary tools and resources to effectively manage their finances and plan for the future. Hence, the Bank is dedicated to continuously expanding financial services through innovative market research and engagement with external parties to develop inclusive products based on client feedback. Guided by our Financial Inclusion Commitment and Financial Well-Being Framework, our products are designed to tailor and personalize financial solutions, addressing the needs of our customers through all stages of life, while also providing non-financial support. The Board of Directors provides strategic guidance and oversees policies and frameworks related to financial inclusion, ensures effective implementation, and maintains the focus on financial inclusion to achieve the Bank’s objectives. The board holds senior management accountable for achieving the targets. The Bank has formed multiple dedicated teams to lead initiatives in key areas such as financial literacy, digital solutions, inclusive financial products and services, prevention of over-indebtedness, and fair treatment.

We have implemented policies and standards to ensure client suitability and affordability, and our products and services are designed to meet customers' needs and lifestyles. Furthermore, the Bank offers debt resolution and restructuring to protect customers from over-indebtedness while promoting good financial behaviors. Moreover, our frontline employees and effective complaints mechanisms are essential components in advancing financial inclusion.

Our employees receive regular training to treat every customer fairly and equally, preventing any form of discrimination based on age, gender, sexual orientation, ethnicity, nationality, religion, beliefs, cultures, or socio-economic background, and avoiding misconduct. Furthermore, our complaints mechanisms are available through various channels such as branches, contact centers, website, and social media, ensuring accessibility for all.

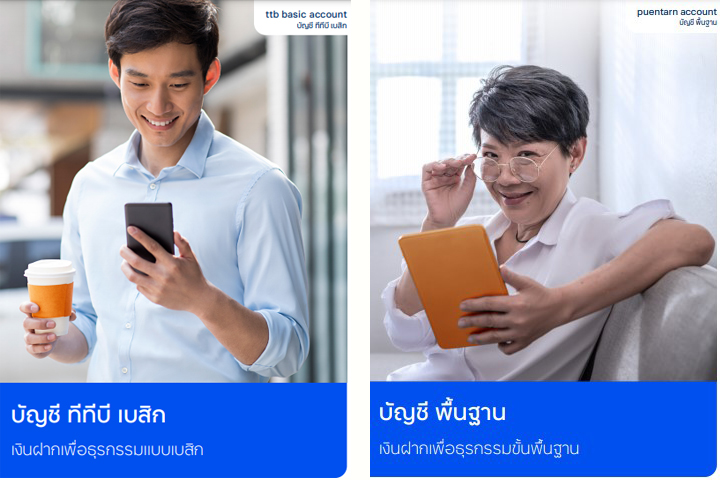

Banking accounts for low-income individuals and senior citizens over 65 years old

The Bank has launched the ttb puentarn account to advance financial inclusion for low-income individuals and senior citizens aged 65 and above. The account opening does not require a minimum amount, and there are no annual fees, account maintenance fees, or transactional fees when using the touch mobile application and ATMs, with no limit on the number of transactions.

Low-income individuals who do not have the government welfare cards can apply for ttb basic account which also does not require initial deposit amount.

Number of accounts and customers reached: 2.1 million accounts/clients

More details about ttb puentarn

More details about ttb basic account

Inclusive microinsurance

The Bank believes that having access to accident and life insurance is a vital shield against unforeseen circumstances and a necessary element to enhance financial well-being for all Thais. However, several vulnerable groups do not have access to the service, particularly the low-income group and the elderly who find insurance fees unaffordable. ttb all free banking account offers accident and life insurance for free with no requirement for medical check-up. The accident insurance covers up to 3,000 baht per accident with an unlimited number of claims, eliminating the need for upfront medical expenses. Additionally, life insurance coverage is 20 times the deposit, with a maximum value of 3 million baht.

Elders up to 70 years old are included in the program. Those aged 71-85 can top up their insurance at a low cost. The account and insurance can be accessed digitally, and no medical check-up is required, allowing customers in rural areas to avoid traveling long distances for hospital check-ups.

Number of accounts: 5 million

Number of customers benefited from accident and life insurance: 2.1 million

More details about ttb all free

Incentivize savings by high interest banking account

ME Savings by ttb is a high-yield digital flexible savings account designed to encourage a saving habit among low-income individuals. The account offers attractive interest rate at 2.20%, higher than normal interest rate, on deposits ranging from 1 to 100,000 Baht. Customers get high interest simply by having higher deposit amount than withdrawal amount in each month. This provides incentive for ongoing saving efforts. Additionally, customers have access to digital tool which provides a support for customers to set financial goals and track progress towards the goals. The account can be opened and accessed digitally with no requirement on minimum initial deposits.

Number of accounts: 491,000 accounts

More details about ttb ME Save

Inclusive home loans for gender equality

Same-sex low-income couples can now have access to home loans, aligning with our commitment to promote equality and financial inclusion for all Thais. Previously in Thailand, only couples with marriage certifications were eligible for such loans, excluding same-sex couples the access to such product. By applying for a home loan with their same-sex partner, low-income individuals can significantly increase their loan amount compared to applying alone, making homeownership more attainable. This financial product supports low-income same-sex individuals, helping them expand their loan budget to achieve their dream of homeownership

Number of loans approved: 89

Number of loans bookings: 52

Total amount of loan: 384 million baht

Reduce burden of high interest loans

ttb debt consolidation program combines accumulated debt from credit cards, car loans and personal loans into a single low-interest rate loan that uses the customer’s house or car as collateral.

Customers who lack collateral such as a car or house, yet maintain a good credit payment history have the option to transfer any loan debt balance from other financial institutions to ttb flash card with lower interest rates.

The debt consolidation program helps simplify repayments by consolidating all debts with multiple banks into one account that customers can keep track of. In addition to offering a fixed end-date for the loan, which customers can work toward, The Bank also give consultation and provide financial literacy to the debtors on their financial management. This will empower customers to better budget their finances and implement a more sensible – and shorter payback plan.

ttb Multi-Purpose Welfare Loan

Low-interest loan for salaried workers, government officers, state enterprise employees whose company or organization use ttb payroll system. The loan value from 5,000 to 1,500,000 baht is easily approved without collateral. Customers can also consolidate debt from up to 4 items.

Investment with minimum 1 baht

A full-service investment portfolio management, which was previously exclusive only to private banking customers, is now available for all customers. The primary objective is to promote smart investment and financial inclusion. In 2021, the bank improved this service to become even more inclusive and accessible by allowing a minimum investment of 1 baht for clients to be able to access this service.

Digital tools for microbusinesses and individuals

My work and My tax are integrated as features in ttb touch, ttb’s mobile banking application, the tools have helped SMEs and customers to manage their finance without any cost.

My work is a tool for SMEs to manage human resources related matters at low affordable price, securely and seamless with payroll service. This also reduce paperwork and time for employees waiting for any salary related documents.

My tax helps anyone who has ttb touch to accessible to tax management at no cost.

Banking agents for customers in remote areas

The Bank offers additional channel to provide convenience for customers living in remote areas and unable to receive services at ttb branches. The Banking agents allow customers to open an online account, perform identity verification, make a deposit, and pay bills. Our partner stores include 7Eleven convenient stores, Tesco Lotus stores, Thailand Post Offices, and Big C branches across the country, making it much more convenient and reducing traveling costs for customers in hard-to-reach areas.

Number of banking agents: over 19,000 branches

Services for bed-ridden patients

Branch employees can provide off-site service to patients, including collecting deposits from customer’s account to pay medical fees as requested by the medical center. This transaction is authenticated by using the Dip Chip and Facial Recognition or by capturing a photo of the customer alongside an identification document. These authentication services can be used at the branch for future transactions. Patients can also prepare a letter of power of attorney to authorize a designated person to conduct transactions at the branch on their behalf. This authorization should be accompanied by a letter from the medical center certifying that the patient cannot be physically transported to the branch and is mentally sound.