Our People

The Bank has policies and Human Resources and Remuneration Committee with duties to review and propose strategic directions on areas related to human resource management namely employee recruitment, remuneration and benefits, regulatory requirements on employment and labor relations as well human rights. Human resource management is a crucial part for the Bank’s continuity and growth. Therefore, the Bank intends to position the Bank to be the workplace where our employees can “Make REAL Change”.

Human Capital Development

The Bank has a strategic training roadmap that is designed to strengthen leadership competency for all employees that empower them to fully perform in line with the Bank’s business goals. Training content is carefully tailored to fit each talent group and match with their needs for their jobs and future roles. The Bank measures Human Capital Return on Investment (HCROI) metric in the past four years (2020-2023). The results are 4.0, 2.8, 3.2, 3.4 respectively.

HR Roadmap and Strategy

At the Bank, we are committed to Make REAL Change in the Thai banking sector. By empowering our employees to always challenge and improve upon the status quo in everything we do, the Bank is in turn able to deliver value to all our stakeholders: our customers, our shareholders, our community and, of course, our employees themselves.

- Our employees have clear career development plan based on individual potentials and required competencies

- Best Development – We are a learning organization with structured development program

- Performance Recognition – We offer a competitive performance-based pay scheme & recognition

- Culture – We empower our employee to Make REAL Change

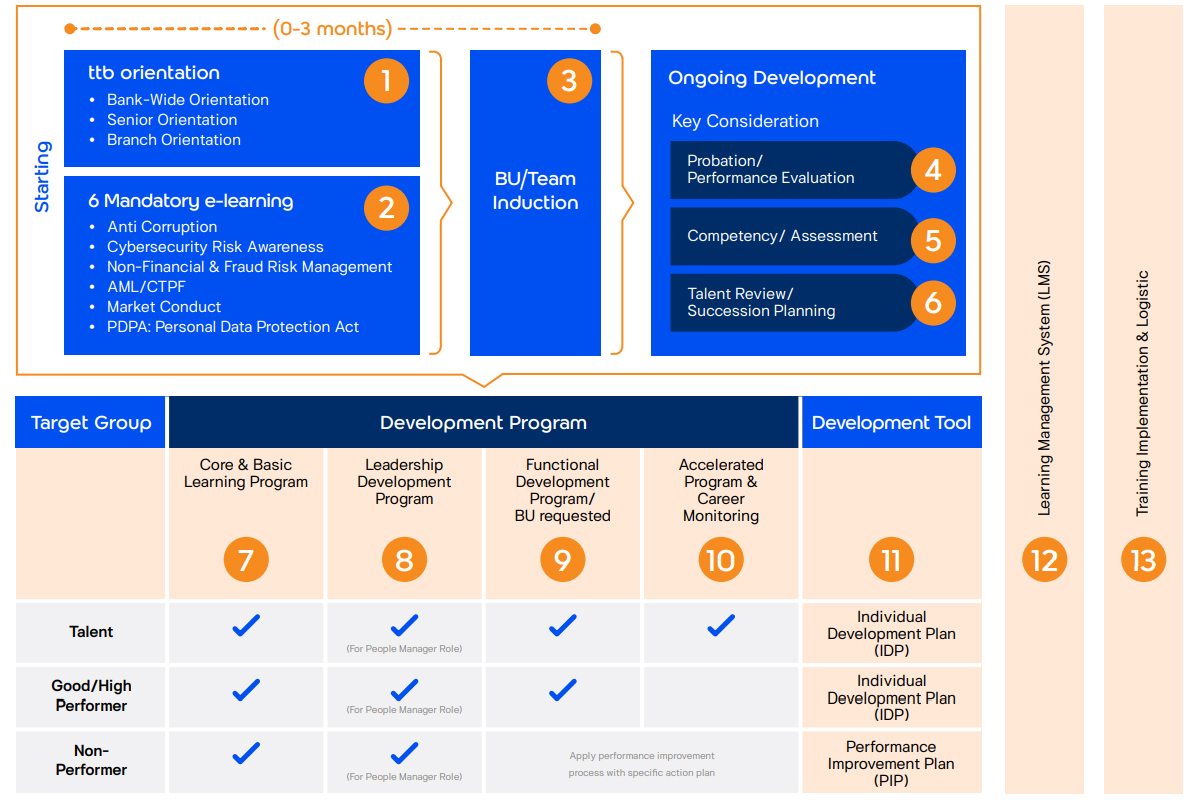

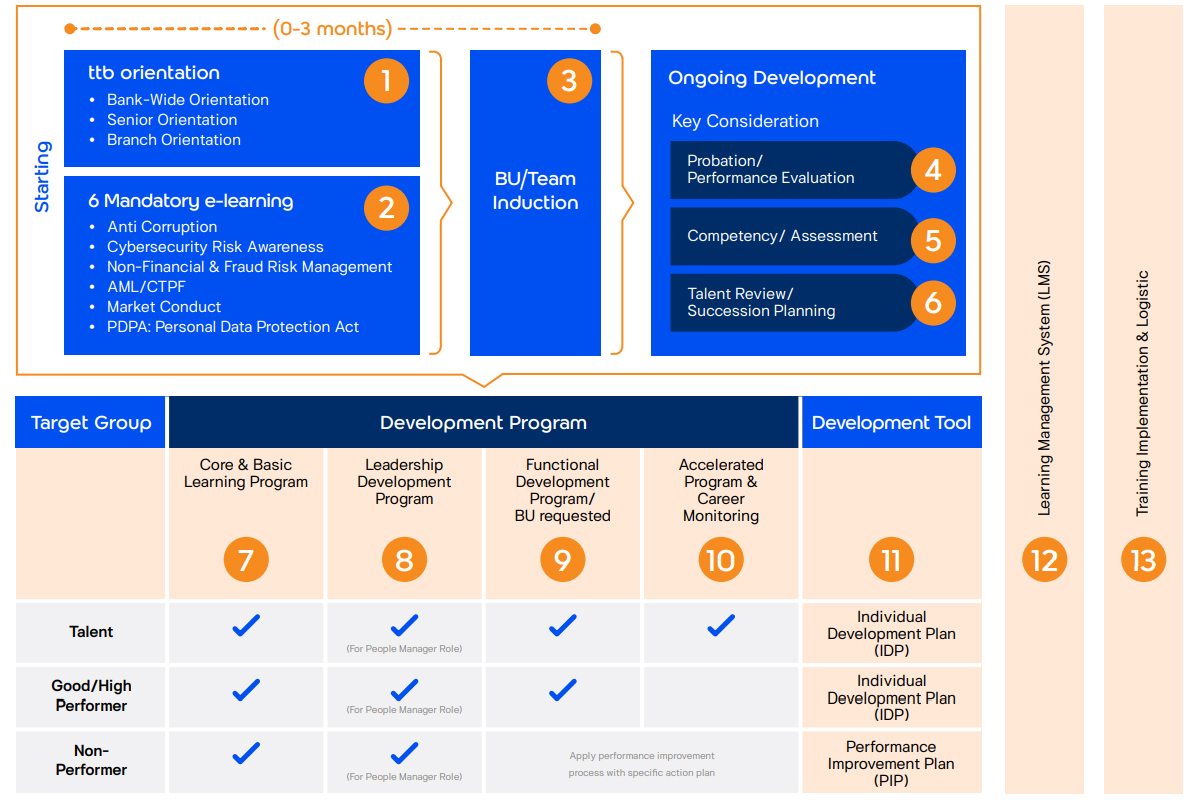

Employee Learning and Development Program

The Bank has a learning and development program to help enhance the effectiveness of employee’s learning and development and support self-learning. Our program emphasizes different aspects:

- Applying the Kirk-Patrick Model for the functional development programs to ensure that the expected business results and behaviors are clearly defined prior to the design of any development programs;

- Increasing involvement of senior management and people managers in co-designing the development programs with HR. This is to build accountability and create a sense of ownership in developing their people;

- Providing a blended learning journey with digital technology that can combine various development solutions (classroom training + virtual classroom + community of practices + knowledge sharing) into one learning platform, where employees can learn from anywhere, at any time, and from any device;

- Strengthening the development content by creating a more integrated/ intervention program with clear objectives, instead of having a variety of fragmented programs; and

- Shifting electronic learning (e-learning) content from long-form learning to a more bite-size/microlearning which is flexible, self-paced, and structured for easy consumption with a clear single objective.

Core Competency Training Roadmap

The Bank designed a training roadmap with customized training content and topics tailored to employees and management at all levels. This was achieved by analyzing the essential behaviors and skills necessary for the Bank’s employees across various proficiency levels. We provide training through several methods, for example, e-learning, classroom training, and community practices. The Bank has also set a training path for employees throughout the organization to create a sustainable learning environment.

Leadership Development Program

The Bank focuses on leadership development for employees at all levels. The leadership development program has been designed to align with the expected roles and responsibilities so that employees can handle different challenges. The program curriculum is designed to build the right mindset, skillset, and toolset in employees. The “First Line Manager” and “Manager of Manager” programs have been developed based on the role of people managers. Managers will acquire either the mindset, skillset, or toolset necessary to enhance their abilities and become effective managers. For senior leaders and top management, the program focuses on widening business perspectives and understanding key business challenges to prepare for rapid changes in the industry.

Learning Platform

The Bank has put in place a learning platform that enables, employees can to learn and interact with the training programs through any mobile devices. The community of discussion and knowledge sharing space can be created with easily accessible. It fully supported the concept of learning at anywhere, anytime and any device. Tthe e-learning contents provided with more than 400 subjects to the employees, so they can choose the program that matches with their needs.

Functional Expertise Enhancement

The Bank offers functional training programs that combine various learning methods including classroom training, e-learning, and community practices for the highest optimization. Examples of functional training programs are data analysis, loan analysis, provision of services, knowledge of the Bank’s products, sales techniques, important regulations, and financial and banking systems.

Blended Learning

The Bank uses the 70:20:10 Model for learning and development through various channels. The model uses a hybrid learning approach that combines online materials with on-site training. Employees can choose the program that meets their needs from more than 500 e-learning content that is accessible through our online platform regardless of location and time. For on-site training, the Bank invites external and internal experts to provide knowledge to employees in various formats including lectures, discussions, coaching, on-the-job training, simulations, and workshops. We provide training to enhance the skills and capacities necessary for changes in the current world.

In addition to enhancing skills for career development, we also bolster our employees’ financial knowledge. They serve as the key driving force in fulfilling our commitment to enhancing the financial well-being of the Thai population.

ttb Awards

ttb values employees’ values innovative efforts to effect real changes for customers and the Bank. As a testament to this commitment, the TTB Awards event is hosted annually. This is an in-house competition that encourages employees to submit initiatives, products, or programs that promote customers’ financial well-being and/or improve the Bank’s performance in 6 areas: revenue generation; sales, service and operational excellence; data-driven risk management; digitalization; people and culture; and Make REAL Change which is the grand prize.

Operational Risk Management and Security Awareness

With the concern on the impact to the customers and the Bank’s reputation, risk management and security awareness are one of the aspects that the Bank has seriously focused. We have then provided various risk and security related training programs i.e. Corporate Operational Risk Management, Anti Money-Laundering, Promoting Risk Awareness, Cyber Threats etc. to our people through the Bank E-Learning system which our employees in all over the country can easily get access to study at any their convenience time.

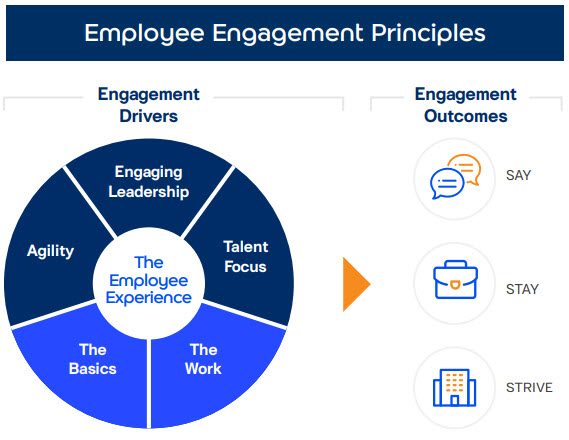

Employee Engagement

The Bank recognizes the importance of employee engagement as the main factor for sustainable organizational growth and development. The Voice of Employee survey or employee engagement survey was conducted annually by Kincentric (Thailand) Co., Ltd. The survey results will be used to improve the organization’s strategies for fostering employee engagement and attracting and retaining talent. The Bank will also develop a plan to enhance employee engagement and employee satisfaction score.

Employees who are engaged have 3 characteristics:

- Say positive things about the organization given the opportunity

- Stay with the organization

- Strive to go above and beyond for the success of the organization

Employees are engaged when they have a good employee experience. Here are the key drivers of employee engagement:

- Engaging Leadership

- Talent focus e.g., career development plan, number of employees, performance assessment

- Agility e.g., collaboration, diversity, customer-centricity

- The Basics e.g., physical health, mental health, stress at work

- The Work e.g., work satisfaction, happiness to work, work that fulfills their life goals

Recognizing the significance of high-potential employees, the Bank provides a long-term incentive for employees through the Employee Joint Investment Program (EJIP), fostering a sense of ownership within the organization. The EJIP program stipulates that the Bank will provide contributions to support employees’ purchase of the company’s shares for 3 years. The shares will be allocated to the participating employees’ account and employees will get dividends and have normal voting rights.

The Bank has a succession plan in place to fill top management positions that will be vacated due to upcoming retirements in future years. To ensure a smooth transition for successors and business continuity, the Bank has identified critical positions and successor profiles. The readiness of potential candidates that have been identified will be assessed against essential criteria, after which, candidates will be allowed to participate in the succession development program to enhance essential skills.

Employee Relations

The Bank recognizes that our employees are the drivers of our business; hence, we respect labor rights of our employees. At the Bank, Welfare Committee is established to ensure fair treatment and to protect the benefits of the employees, with a biannually meeting at a minimum. The employee representatives meet with HR function every 6 months to discuss issues regarding employees’ rights, benefits, and concerns. After the discussions, HR reports the key summary to the management committee for further decisions and actions.

Moreover, the Bank has four employee unions: Thai Military Workers Union, Thai Military Employees Labor Union, Thai Military Bank Labor Union, and TMB Thanachart Labor Union , accounting for 20% of total employees.

The Bank and Employees have jointly established The Registered Provident Fund of TMBThanachart Bank Public Company Limited, which is managed by The Board of Directors of The Registered Provident Fund of TMB Bank Public Company Limited comprising employers, which come from the appointment and employees which come from the election from the member. The fund is managed under the Employee’s Choice scheme in which the employee can choose to save at the rate of 2-15% of their salary while the Bank contributes 5-10% to the fund. As of 31 December 2023, the Bank has 14,328 employees, with 13,046 or 91% of total employees participating in the Provident Fund.

Employee Performance Appraisal

The bank has implemented an internal process to assess employee performance, known as the employee evaluation appraisal. The primary objectives of this appraisal system are to promote teamwork, foster ttb culture and ensure compliance with the Code of Conduct, facilitate agile conversations, and enhance employee well-being. The process for evaluating employee performance consists of the following steps: 1) Define Criteria 2) Checkpoint (Mid-Year Review) 3) Finalize Criteria 4) Evaluation. Additionally, the bank employs both individual and team-based performance evaluations in this appraisal process. It emphasizes ongoing feedback through multidimensional performance appraisal approach, allowing for continuous communication between employees and their line managers.

Health, Safety, and Well-being

The Workplace Safety and Physical Security Policy provides approach to managing occupational health, workplace environmental safety, and physical security. Workplace Safety and Physical Security Policy is approved by Risk Oversight Committee (ROC) at the board level. The Occupational Safety, Health and Environment (OSHE) Committee is chaired by the CEO. The Committee consists of employer and employee representatives, with the Safety Officer serving as a secretary of the Committee. The OSHE Committee holds monthly meeting to consult and discuss safety issues identified by employees, develop necessary safety measures, monitor performance, and assess effectiveness of actions and plans implemented e.g., evaluating progress of reducing/preventing health issues/risks against targets. The OSHE Committee will ensure the adequate implementation of the requirements indicated in this policy as well as develop plans, taking into account this policy, on health and safety to prevent and reduce accidents, dangers, sickness, or annoyance resulting from Bank’s work and non-work related activities. Other parties involve in the management and execution at the operational level include Corporate Property and Services, Business Continuity Management, Department Heads in business units and support units (e.g., HR, etc.), managers of branches and other sales offices.

The Bank has a Zero Accident and zero Lost Day Injury Rate (LDIR) target, demonstrating its commitment to health and safety. The OSHE Committee ensures the adequate implementation of all OSHE requirements indicated in the policy and in the Ministerial Regulation on the Prescribing of Standard for Administration and Management of Occupational Safety, Health, and Environment 2006.

The Bank performs annual physical security assessment to ensure the adequate implementation and compliance with this policy including reporting and tracking status of non-compliance issues resolution in GRC. Health and safety risks are analyzed and identified to mitigate the impacts. Safety action plans and targets are in place to effectively manage health and safety issues; also, internal and external safety inspections are conducted regularly. The progress and update of health and safety matters are regularly communicated to the executive management, especially during the world pandemic, Covid-19.

All job activities are analyzed for any exposures to health and safety hazards where 3 job activities are currently at high risk including call center with exposure to noise and storage room and printing with exposure to hydrocarbon and volatile organic compounds. While appropriate control measures are put in place to control risks in these areas, should employees be found to have levels of these substances that are higher than the legal standards, the employee will receive appropriate treatment. The Bank will also investigate the causes of exposure and conduct regular testing on the affected employees until their health returns to normal.

Workplace Safety and Physical Security Policy

Workplace Safety and Physical Security Policy

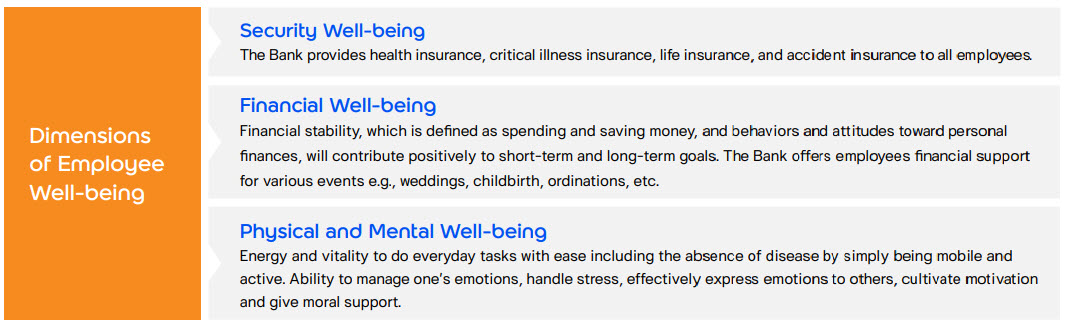

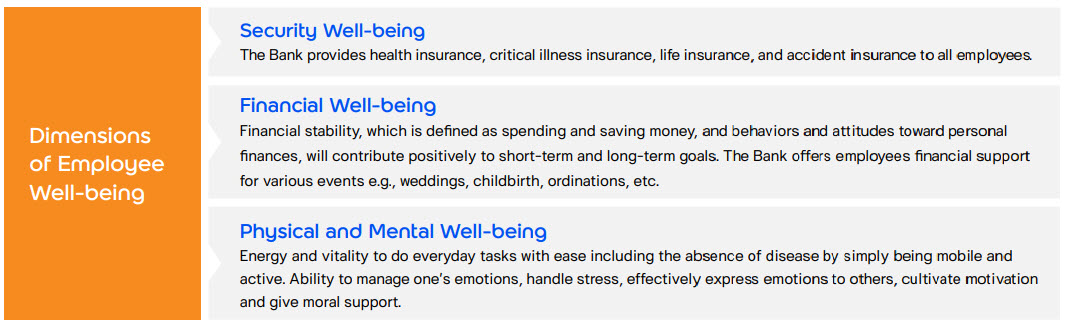

Employee Health and Well-being

The Bank takes care of our employees’ health and well-being in order to maintain a healthy and mindful workforce that helps advance the business. Safety measures are in place to ensure a safe environment for employees, customers and visitors. To build employee awareness, foster health and a culture of well-being, the Bank offers employees with benefits and conducts initiatives as follows:

Types of leave

- Personal Business Leave: 10 working days per year with full pay for employees to carry out personal business including taking care of family members with a physical or mental health condition (care leave), dealing with government agencies, bereavement leave, wedding leave, commencement ceremony, and any other occasions approved by the direct line manager

- Annual Leave: At least 10 days per year excluding public holidays (according to the length of service)

- Sick Leave: Paid sick leave for no more than 30 working days per year

- Ordination Leave: One-time ordination leave for no more than 120 days for the entire duration of the employment period

- Hajj Leave: One-time Hajj leave with full pay for no more than 45 days of the entire duration of the employment period

Support for employees with family commitments

- Paid parental leave for primary and non-primary caregiver: Full paid maternity leave of 14 weeks and full paid paternity leave of 5 days (week).

- A private lactation room with equipment and storage for mothers to use for pumping breast milk.

- Scholarship for employees’ children with a value of THB13,000 per academic year as one of childcare facilities.

Medical and well-being facilities

- In-house medical clinic at the Headquarter

- Fitness center

- Internal communication about health issues e.g. ergonomics, health, and nutrition, etc.

- Health check-up programs based on risk exposures such as audiogram test for call center staffs, spirometry and volatile organic compounds tests for staff who work in storage room and printing who are exposed to health hazards.

- Key indicators monitoring including indoor temperature, humidity, illumination, noise, particulate matter, chemical and bacteria in air, bacteria at the canteen, drinking water quality, hydrocarbon and volatile organic compounds in area at risk. The Bank regularly assesses these indicators for a healthy and safe work environment for employees’ well-being at least annually by external service providers.

- Flexibility of working hours and working-from-home arrangement

Diversity in Workplace

The Bank commits to promoting diversity, equity, and inclusion. Above all, the Bank has zero tolerance for any behavior which is discriminatory on grounds of age, gender, sexual orientation, ethnicity, race, country of origin, nationality, cultural background, religion, belief, cultures, and socio-economic background. We believe that diversity is important for sustainable growth.

Since the launch of ttb’s Diversity and Inclusion Statement, which was approved by the Chief Executive Officer and the Board of Directors in 2019, the Bank has been publishing diversity and gender equality data and has continuously improved our corporate culture to support this commitment.

One of the Bank’s key objectives is exemplified by the 2023 target to ensure that at least 40% of the workforce consists of women across all positions, including management roles, operational functions, revenue-generating positions, and STEM-related functions. Our compensation framework mandates that remuneration is to be determined by role and performance, irrespective of gender, ensuring equity at all levels. Furthermore, we regularly assess gender pay equity.

In addition to the rights at work, the Bank requires that all employees undergo an online Code of Conduct refresher training annually. The training covers content on equity and inclusion, emphasizing individual rights and prohibition of discrimination and harassment as well as the rights of the individual. This ensures that employees exhibit appropriate conduct towards both customers and others.

In addition to the rights at work, the Bank requires that all employees undergo an online Code of Conduct refresher training annually. The training covers content on equity and inclusion, emphasizing individual rights and prohibition of discrimination and harassment as well as the rights of the individual. This ensures that employees exhibit appropriate conduct towards both customers and others.

Diversity and Inclusion Statement

Diversity and Inclusion Statement

Workplace Safety and Physical Security Policy

Workplace Safety and Physical Security Policy